43 403b vs 401k

What's the Difference Between a 401(k) and a 403(b)? 403(b) A 403(b) account is similar to the 401(k) plan, though it usually takes the form of annuity contracts or mutual fund custodial accounts. Similarly, its name refers to the tax code that established it, but 403(b)s are also known as "tax sheltered annuity" (TSA) plans. 403(b) Vs. 401(k): Comparison, Pros & Cons, Examples 403 (b)s are for government or non-profit employees, while 401 (k)s are offered by for-profit companies. Alyssa Powell/Insider 403 (b) and 401 (k) plans are similar retirement savings tools offered...

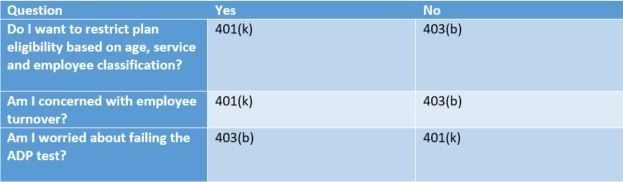

› retirement › 403b-vs-401k403(b) vs. 401(k): What’s the Difference? | RamseySolutions.com Jan 20, 2022 · Eligibility: 401(k) plans are offered by for-profit companies, and 403(b) plans are offered by tax-exempt organizations, such as hospitals, schools, universities, nonprofits and religious organizations. Investment Options: 403(b) plans only offer mutual funds and annuities, but 401(k) plans offer mutual funds, annuities, stocks and bonds. Because 401(k) plans are more expensive for the company, they usually offer a wider range and sometimes better quality of investment options.

403b vs 401k

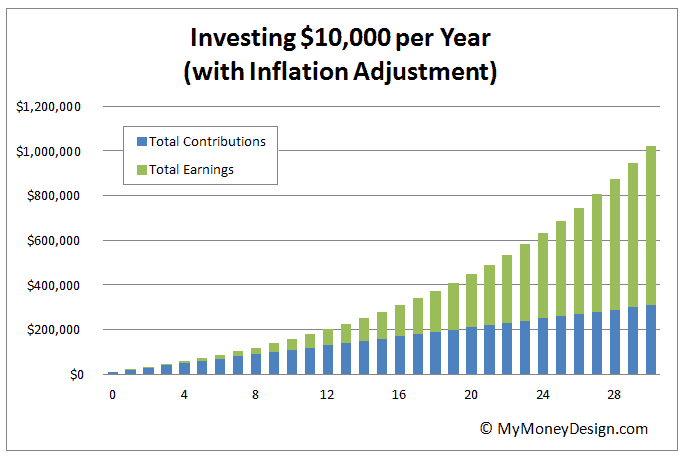

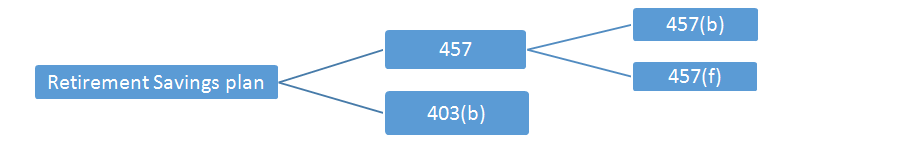

403(b) vs. 401(k) vs. 457(b) | John Hancock Retirement they all allow you to save the same amount of money from your paycheck for the year, although 403 (b)s and 401 (k)s allow for higher contributions from the employer. 403 (b)s and 457 (b)s allow you to make special contributions to increase your retirement savings, but they have different eligibility criteria—you must have 15 years of service for … › advisor › retirement403b Vs. 401k: What’s The Difference? – Forbes Advisor If your employer complies with ERISA and offers employer 403 (b) contributions, you may face a vesting period. This, however, is normally shorter than 401 (k) vesting periods. 403 (b) Contribution... 401(a) vs. 403(b) | What You Need to Know - SmartAsset Tax Benefits of 403(b) Plans. In terms of tax treatment, a 403(b) functions similarly to a 401(a). You make pre-tax contributions, and your money grows tax-free. However, you will owe regular income tax on eligible withdrawals. You can also make these at age 59.5. The 10% early-withdrawal penalty rule applies. 403(b) Plan Contribution Limits

403b vs 401k. How is a 403(b) different from a 401(k)? - Ultimate Guide ... A 403(b) plan is a kind of defined contribution retirement plan that may be offered to employees of government and tax-exempt groups, such as schools, hospitals and churches. › ask › answersThe Differences Between 401(k) and 403(b) Plans Notably, 401 (k) plans tend to be administered by mutual fund companies, while 403 (b) plans are more often administered by insurance companies. This is one reason why many 403 (b) plans limit... ssofficelocation.com › resources › 403b-vs-401k403(b) Plan vs. 401(k) Plan: What's The Difference? | (Full ... A 403b, on the other hand, can only be offered by educational institutions and tax-exempt organizations. All employees are eligible to participate, but the employers may limit their participation rules more tightly than with a 401k. This applies to both government employers and non-profits. Contribution Limits walletgenius.com › investing › 403b-vs-401k-plans403b vs 401k Plans: What's Better For Retirement - WalletGenius Apr 23, 2021 · The main difference between the two plans is the type of employer sponsoring them. Typically, 401k plans are offered by private, for-profit companies. Meanwhile 403b plans are generally provided by non-profit organizations or government employers. So which plan you have access too probably depends on who you work for.

403(b) vs 401(k): Complete Retirement Plans Comparison ... A 403 (b) plan is similar to a 401 (k). The major difference is a 403 (b) plan is used by non-profit companies, religious groups, school districts, and some government organizations. Most workplaces that qualify to offer a 403 (b) will not also provide a 401 (k). And for-profit corporations don't have the option of offering a 403 (b). 403b vs 401k: Differences and Similarities - Brandon ... The primary difference between a 403b vs 401k retirement account is who uses them. A 401k is for people employed by a for-profit organization. In contrast, the 403 (b) plan is for those who work for a non-profit organization. Some typical examples include teachers, members of religious organizations, and hospital employees. PDF COMPARISON OF 401(k) AND 403(b) PLANS In general, the new regulations narrow the difference between 401(k) and 403(b) plans, making 403(b) plans much more like their 401(k) cousins. ERISA vs. non-ERISA plans - 403(b) plans without employer contributions, or those sponsored by governmental employers or churches will not automatically be subject to ERISA. 403(b) vs. 401(k): What's the Difference? | The Motley Fool The 401 (k) and 403 (b) are both tax-advantaged retirement accounts named after different sections of the tax code. While similar in many ways, 403 (b)s are offered only to public school employees,...

403b Vs. 401k: What's The Difference? | Clever Girl Finance 403b accounts can only offer mutual funds and annuities, while 401ks can offer these plus other types of investments like individual stocks. This isn't that big a deal, since it's usually best to choose from a mix of mutual funds with either account. The 3-fund portfolio is a very simple and well-diversified way to invest in different asset types. 403(b) vs. 401(k) - What's the Difference? - SmartAsset 403(b) vs. 401(k): Differences. There are some noteworthy differences between a 403(b) vs. a 401(k). The most important is the types of companies that offer the two plans. For-profit companies offer 401(k) plans. Most people work at for-profit companies, meaning the majority of retirement plan participants use a 401(k.) › which-is-better-for-your403(b) vs 401(k) Accounts: What's the Difference? Dec 19, 2021 · Another difference between a 403 (b) and a 401 (k) is the investment choices. Most 401 (k) plans offer different types of mutual funds as their investment choices, but they can include other investment types. 403 (b) plans can only offer mutual funds and annuities. 3 Technically, 403 (b)s are more limited on investing options than 401 (k)s, but if there is a choice between mutual funds, then a 403 (b) can be nearly as flexible as a 401 (k). 401(k) vs. 403(b): What's the Difference and Which is ... Differences in Investment Options for 401(k) vs. 403(b) As noted above, 401(k) plan participants tend to have a larger menu of investment options than 403(b) plan consumers, who are usually ...

403(b) vs. 401(k): What's the Difference? — Tally There are also employer-sponsored retirement plans, like a 403(b) or 401(k). Confusingly named, both offerings may appear to be a jumbling of letters, numbers and punctuation. While they share similarities, 403(b)s and 401(k)s do have a few distinguishing differences. In this article, we'll provide: A breakdown of 403(b) vs. 401(k)

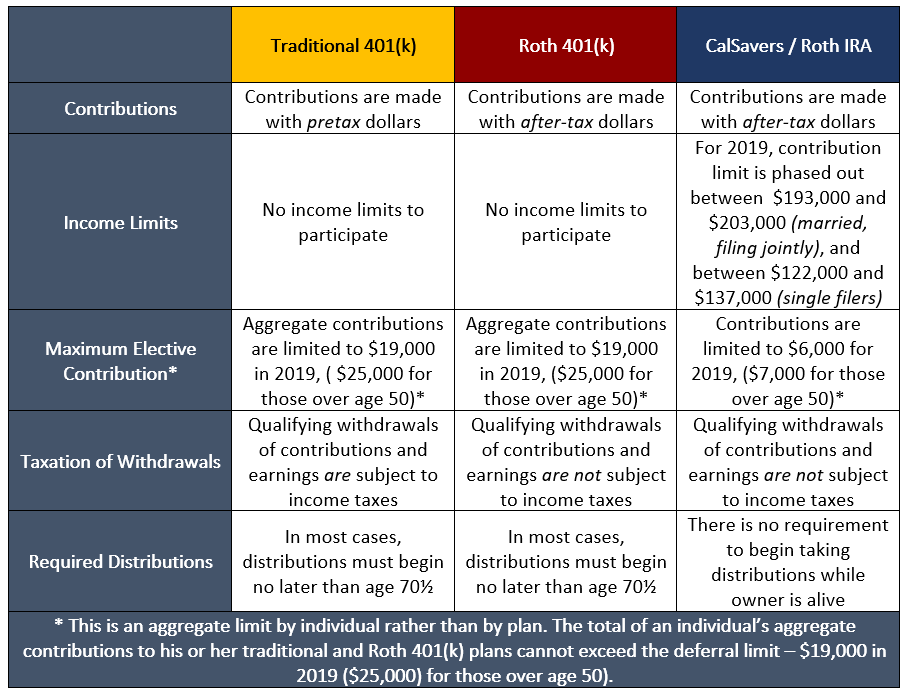

› resources › file-6878242022 403(b) vs. 401(k) comparison chart 2022 403(b) vs. 401(k) comparison chart Feature 403(b) 401(k) Eligible employer Educational organizations and nonprofi t organizations under 501(c)(3) of the IRC Any employer Eligible employees All employees but may exclude: • Employees who work less than 20 hours per week • Professors on sabbaticals • Certain students

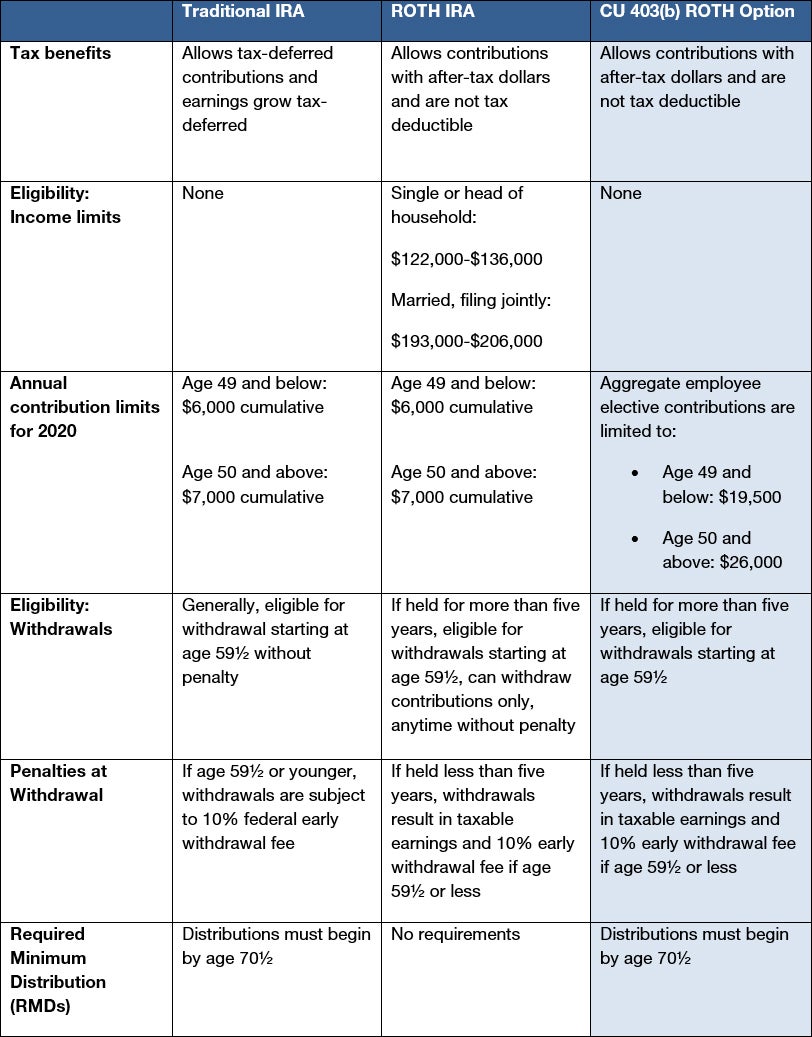

401(a) vs. 403(b) | What You Need to Know - SmartAsset Tax Benefits of 403(b) Plans. In terms of tax treatment, a 403(b) functions similarly to a 401(a). You make pre-tax contributions, and your money grows tax-free. However, you will owe regular income tax on eligible withdrawals. You can also make these at age 59.5. The 10% early-withdrawal penalty rule applies. 403(b) Plan Contribution Limits

› advisor › retirement403b Vs. 401k: What’s The Difference? – Forbes Advisor If your employer complies with ERISA and offers employer 403 (b) contributions, you may face a vesting period. This, however, is normally shorter than 401 (k) vesting periods. 403 (b) Contribution...

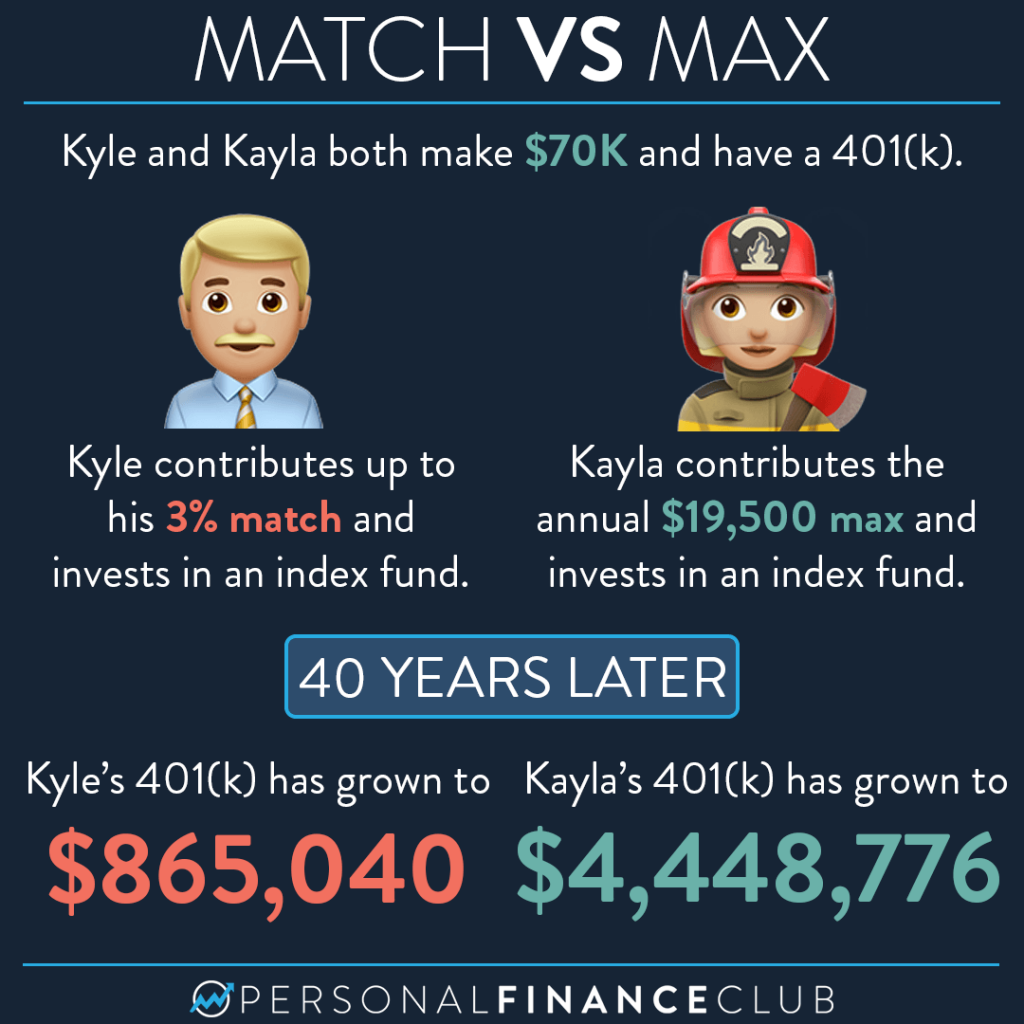

403(b) vs. 401(k) vs. 457(b) | John Hancock Retirement they all allow you to save the same amount of money from your paycheck for the year, although 403 (b)s and 401 (k)s allow for higher contributions from the employer. 403 (b)s and 457 (b)s allow you to make special contributions to increase your retirement savings, but they have different eligibility criteria—you must have 15 years of service for …

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/agreement-and--discussion-1189829021-109d3b8bd8854ad1b0b7b981355d0571.jpg)

![403(b) Plan vs Roth IRA [INFOGRAPHIC] | Inside Your IRA](https://insideyourira.com/wp-content/uploads/2018/10/20190424-IYIRA-ROTH-IRA-vs-403B.jpg)

0 Response to "43 403b vs 401k"

Post a Comment